RPA (Robotic Process Automation)

Invoice Processing Automation with RPA

Invoice processing is a critical function for businesses of all sizes, yet it is often manual, time-consuming, and prone to human error. From receiving invoices to approving payments and recording transactions, the traditional process requires significant administrative effort. This often results in delayed payments, discrepancies, and high operational costs.

Robotic Process Automation (RPA) offers a solution that automates invoice processing, helping companies streamline workflows, reduce manual errors, and speed up the overall invoicing cycle. By automating tasks such as data extraction, verification, and approval, RPA ensures that invoices are processed faster and more accurately, freeing up staff to focus on higher-value activities.

Discover more about this product.

Click here to book your demo.

How RPA Transforms Invoice Processing

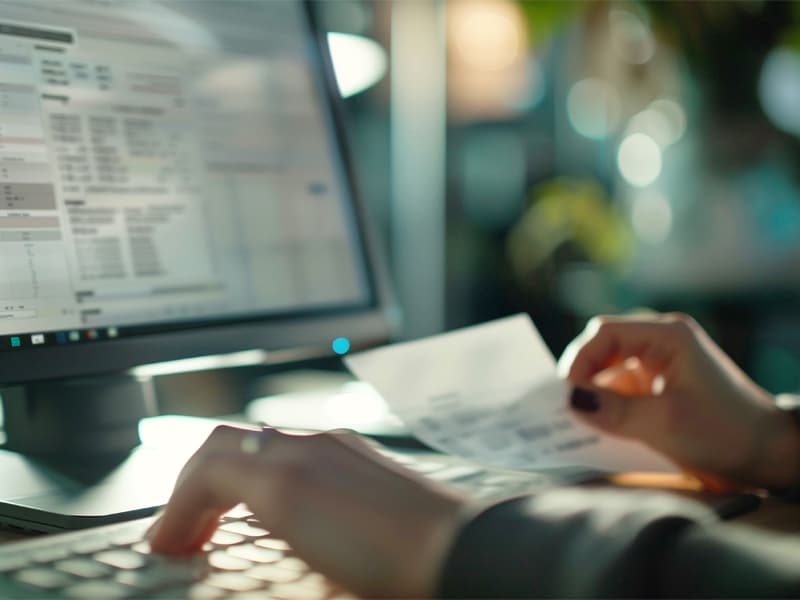

Manual Data Entry

Invoice data often needs to be manually entered into the accounting system, leading to time-consuming tasks and potential errors. Even a small mistake can cause payment delays or miscommunication with suppliers. RPA automates this data entry process by extracting key information from invoices - including amounts, dates, and vendor details - and entering it directly into your system.

Invoice Approval Bottlenecks

Many organizations have complex approval processes for invoices, involving multiple stakeholders across different departments. This can result in delays in processing payments and cause frustration for suppliers. RPA can help by automatically routing invoices to the appropriate individuals for approval based on predefined rules, reducing approval bottlenecks and speeding up payment cycles.

Duplicate Invoices and Fraud Detection

Duplicate invoices or fraudulent submissions are significant risks in manual invoicing processes. With RPA, businesses can set up validation checks to ensure that invoices are not duplicated and that all submitted invoices are legitimate, reducing the risk of fraud and financial discrepancies.

Invoice Matching Errors

Matching invoices to purchase orders or contracts is often a manual task, and errors can occur when there are discrepancies between the amounts or line items. RPA can automatically perform three-way matching between invoices, purchase orders, and goods receipts, flagging any discrepancies and ensuring that only accurate invoices are processed for payment.

Lack of Visibility and Reporting

In many organizations, invoice processing is done manually, and visibility into the status of invoices can be limited. RPA provides real-time tracking and reporting, allowing organizations to have full visibility into the status of invoices, approval workflows, and payments.

Benefits of RPA for Invoice Processing

- Faster Processing Times: RPA can process invoices in a fraction of the time it takes manually, speeding up the invoicing cycle and improving cash flow.

- Reduced Errors: By automating data entry and invoice matching, RPA significantly reduces the risk of human error, ensuring accurate records and fewer payment discrepancies.

- Lower Operational Costs: Automating invoice processing reduces the need for manual labor and helps businesses reduce the costs associated with manual processing and errors.

- Improved Supplier Relationships: Faster, more accurate invoice processing leads to timely payments, which can improve relationships with suppliers and potentially unlock early payment discounts.

- Better Compliance: RPA ensures that invoices are processed according to company policies, legal requirements, and contractual terms, improving overall compliance and audit readiness.

Who Benefits the Most?

- Accounts Payable Teams: Automate repetitive tasks such as data entry, invoice matching, and approval routing to save time and reduce the risk of errors.

- Finance Directors: Gain real-time visibility into the status of invoices and payments, improving cash flow management and financial reporting.

- Procurement Teams: Ensure that invoices are matched to purchase orders and contracts, reducing discrepancies and improving supplier relationships.

- Suppliers: Enjoy faster payment processing, improving their cash flow and strengthening their relationship with your company.

- Operations Teams: Benefits from streamlined processes and faster invoice turnaround times, which support smoother workflows and reduce bottlenecks across departments.

With RPA, invoice processing can become a streamlined, efficient function that reduces manual errors, speeds up payment cycles, and enhances financial accuracy. Automating this critical business function will allow your finance team to focus on more strategic tasks while improving overall financial management.

FAQs

How Does RPA Improve Invoice Processing?

RPA improves invoice processing by automating the data extraction from invoices, matching invoices with purchase orders, routing invoices for approval, and generating real-time reports, reducing manual effort and errors.

Can RPA Help Detect Duplicate Invoices?

Yes, RPA can compare incoming invoices with previously processed ones and automatically detect duplicates, preventing overpayments and fraud.

How Can RPA Integrate with Existing Financial Systems?

RPA integrates seamlessly with ERP systems, accounting software, and invoicing platforms, allowing businesses to automate end-to-end invoice processing without disrupting existing workflows.

We’re here to provide you with more details.

Reach out today!